As a young adult entering your early career years, you’re at the right moment to secure your health and lifelong protection through insurance. With so many types of insurance plans available, it can become a confusing affair.

This article will guide you through the different types of insurance and the benefits of each. Pick the ones that suit you best and gain enhanced protection while enjoying affordable premiums at a younger age.

Related Story: How Do You Get the Most Value Out of Your Insurance Plan?

Health Insurance

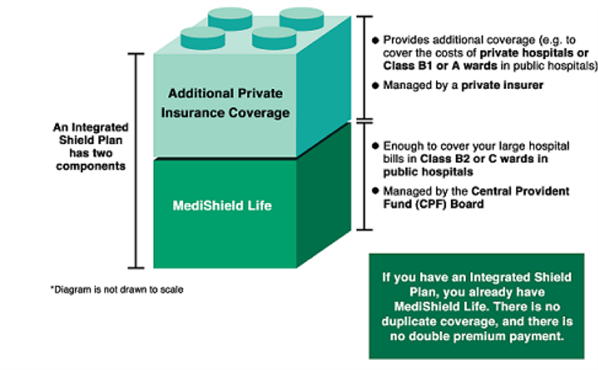

MediShield Life is Singapore’s compulsory health insurance scheme covering a range of expensive outpatient treatments like chemotherapy and dialysis and large public hospital bills. An Integrated Shield Plan (IP), however, enhances your MediShield Life coverage as it gives you access to a wider health insurance coverage net.

If you’d like a Class A or B1 ward at a public hospital or access to private hospitals, you can opt for one of the seven MediSave-approved private IPs: Income, Great Eastern, AIA, Singlife, Prudential, HSBC, and Raffles Health.

How do MediShield Life and Integrated Shield Plans work?

The infographic below illustrates how both plans complement each other with no overlapping coverage.

Source: Ministry of Health, Singapore

Types of Integrated Shield Plans

There are currently seven active insurers offering IPs: AIA, Singlife, Great Eastern, Income, Prudential, Raffles, and HSBC. The table below illustrates the Plan types (according to its respective ward type).

|

Insurer |

Ward Coverage Type & Plan |

|

Income |

Basic Plan B2/C Ward Income IncomeShield Plan C* Income Enhanced IncomeShield C* Public Hospital Class B1 Income IncomeShield Standard Plan Class B1 Income IncomeShield Plan B* Income Enhanced IncomeShield Basic Class A Income IncomeShield Plan A* Income Enhanced IncomeShield Advantage Private Income IncomeShield Plan P Income Enhanced IncomeShield Preferred |

|

Great Eastern |

Public Hospital Class B1 Great Eastern GREAT SupremeHealth Standard Class B1 Great Eastern GREAT SupremeHealth B* Great Eastern GREAT SupremeHealth B Plus Class A Great Eastern GREAT SupremeHealth A Plus Private Great Eastern GREAT SupremeHealth A* Great Eastern GREAT SupremeHealth P Plus |

|

AIA |

Public Hospital Class B1 AIA HealthShield Gold Max Standard Plan Class B1 AIA HealthShield Gold Max C* AIA HealthShield Gold Max B Lite Class A AIA HealthShield Gold Max B Private AIA HealthShield Gold Max A |

|

Singlife |

Public Hospital Class B1 Singlife Shield Standard Plan Class B1 Singlife Shield Plan 3 Class A Singlife Shield Plan 2 Private Singlife Shield Plan 1 |

|

Prudential |

Public Hospital Class B1 Prudential PRUShield Standard Plan Class B1 Prudential PRUShield B* Class A Prudential PRUShield A* Prudential PRUShield Plus Private Prudential PRUShield Premier |

|

HSBC |

Public Hospital Class B1 HSBC Life Shield Standard Plan Class A HSBC Life Shield Plan B Private HSBC Life Shield Plan A |

|

Raffles |

Public Hospital Class B1 Raffles Shield Standard Plan Class B1 Raffles Shield B Class A Raffles Shield A Private Raffles Shield Private |

*These plans are no longer offered to new members, but existing members can continue to renew their policies

Source: Ministry of Health, Singapore

Who can purchase IPs?

The eligibility requirements may vary by plan, but in order to qualify for an IP, one must be a Singapore citizen, permanent resident of Singapore, or foreigner (conditions apply).

These two Integrated Shield Plans can pair well with your existing MediShield Life coverage.

|

Insurance |

Great Eastern GREAT SupremeHealth Standard |

Income Enhanced IncomeShield Advantage |

|

Best For |

Simple and budget-friendly Standard plan |

Affordable family coverage in Type-A wards |

|

Overview |

|

|

|

Co-Insurance |

10% |

10% |

|

Hospital Type |

Public B1 Ward and below |

Public B1 Ward (Basic), A Wards (Advantage), Private Hospitals (Preferred) |

|

Eligibility Requirement |

Singapore Citizens Permanent Residents |

Singapore Citizens Permanent Residents Foreigners |

|

Last Entry Age |

75 (next birthday age) |

|

Life Insurance

Life insurance consists of two types — whole life insurance and term life insurance. The purpose of life insurance is unique; it aims to alleviate the financial burden your family may have in the event of your death. Payouts happen when the policyholder passes on.

While preparing for your death may seem like a distant worry as a young adult, many adults regret not purchasing a life insurance plan, simply because its importance and premium prices escalate in tandem, and it becomes a costlier yet crucial investment later on.

Acquiring life insurance while you’re young helps you secure affordable premiums, as your health and age are important factors towards the premiums payable for your life insurance plan. Unless you choose to change the coverage amount, your premiums will most probably remain the same for your policy duration.

Here are two term life insurance plans you can consider.

|

Direct Purchase Insurance (DPI) |

Etiqa Direct Purchase Term Life/ Whole Life Insurance |

|

|

Best For |

Ability to buy online without requiring financial advice |

One of the most affordable term life DPI options for young consumers (20s and 30s) and females |

|

Overview |

Life insurance coverage from S$100,000 to S$1,500,000 Adjust your coverage based on your milestones and enjoy the flexibility to increase your coverage upon your life’s big events without providing any evidence of good health. Protection for your loved one: Your spouse is eligible for a complimentary insurance policy of up to S$250,000 without any underwriting for one year in the event of your death or terminal illness. Get additional protection with the Total and Permanent Disability rider, Critical Illness rider, and Premium Waiver rider. |

Life insurance coverage from S$50,000 to S$2,000,000 Life insurance coverage up to S$200,000 |

|

Eligibility |

Between 18 to 65 years (both years inclusive) A resident of Singapore with a valid NRIC or FIN Meet health conditions per criteria |

A Singapore tax resident with a valid NRIC or FIN Between the age of 19 and 65 years (next birthday Resided in Singapore for more than 182 days before the date of purchase Not an undischarged bankrupt Proficient in spoken or written English Not purchasing plan to replace any existing policy with Etiqa or other insurer(s) |

|

Promotion |

22 April to 30 April 2024 |

NA |

Related Story: Best Personal Accident Insurance Plans in Singapore

Critical Illness Insurance

So you’ve got MediShield Life for basic health insurance and an Integrated Shield Plan to supplement coverage beyond MediShield Life. Where does Critical Illness (CI) insurance fit into the picture? Why consider it to begin with?

While the first two MediShield insurances aim to cover your medical expenses and hospitalisation costs, a critical illness insurance plan gives you a lump-sum payment if you’re diagnosed with any of the 37 critical illnesses defined by the Life Insurance Association, including heart attack, stroke, and cancer.

Assessing your need for critical illness insurance

As with life insurance, CI policies are more budget-friendly when you’re younger and in better health. Take note that CIs exclude coverage for pre-existing medical conditions. If you opt to wait for later and eventually get diagnosed with certain medical conditions, chances are you may not be able to secure insurance coverage against the illnesses, affecting your CI policy value.

Here are two CI insurance plans that can safeguard you financially from critical illnesses.

|

Insurance Plan |

||

|

Best For |

Coverage for most common critical illnesses — cancer, heart attack, and stroke |

Most comprehensive cancer coverage |

|

Overview |

Provides cover for all cancer stages, late-stage heart attack, and late-stage stroke 100% lump-sum cash payout with flexibility to use for treatment or other commitments Renewable up to the age of 85 years Optional Heart & Neurological Disorder Benefit |

Cancer-only plan Major Cancer Benefit Full payment of S$100,000 upon major cancer diagnosis Accelerated Benefit 50% of the sum assured upon early-stage cancer diagnosis Continues with automatic renewal even after even after Accelerated Benefit payout |

|

Eligibility |

Between 18 to 65 years old (both inclusive) A Singapore resident holding an NRIC or FIN Completed online health declaration |

Aged between 20 to below 65 years of age Residing in Singapore |

|

Promotion |

8 April to 30 April 2024 Use promo code “POLICYPAL” to get 35% discount |

28 March to 6 May 2024 Get 20% discount when you BUY NOW! |

Home and Car Insurance

Car Insurance

As fresh graduates start off on their career path, the prospect of owning a home or car might not be in their short- to mid-term plan. The soaring Certificate of Entitlement (COE) prices make car ownership seem like a financial challenge. Understanding the dynamics of owning a car in Singapore—including car insurance—is essential, even if you’re not considering ownership now.

Car insurance is compulsory for owning a car in Singapore and is a means to protect yourself from unforeseen medical bills and legal fees. Car accidents are more common than people think, and with benefits like car repair coverage, towing costs, and alternative transport thrown in, car insurance saves you from a lot of hassle.

Related Story: Best Car Insurance Plans in Singapore

Home Insurance

Home insurance plans are another serious coverage to consider when you get your own comfy place to live in. It can cover you in various aspects, including home renovations, personal belongings, medical expenses, and burglaries.

Related Story: Your Guide to The Best Home Insurance in Singapore (2023)

Travel Insurance

Whether it’s jetting off to exotic destinations or exploring the sights of a different city with fresh eyes, young adults today find it thrilling to pack and go off on an adventure. More than ticking off places on a map, travelling is a quest for personal growth, unforgettable experiences, and a break from the everyday grind.

Travel insurance and travelling go hand-in-hand if you want a stress-free trip without compromising your medical coverage and other trip-related factors. It covers many things, including trip cancellations and delays, medical bills while you’re abroad, accidental injuries, and the loss of your personal belongings.

Travel insurance in Singapore

There are a number of travel insurances available in Singapore, which you can pick based on your lifestyle and travelling frequency. You can opt for single-trip travel insurance if it’s just a one-off trip, or go for an annual plan if you’re travelling several times in a year.

Here are two of the best travel insurance plans you can check out, based on a one-week trip to ASEAN for this table’s benefits coverage.

|

Insurance Plan |

|||

|

Best For |

Travel coverage comprising over 50 benefits |

One of the most budget-friendly plans |

A great mix of cost-friendly and value |

|

Overview |

Overseas Medical S$250,000 (Adult below 70 years) Accidental Death & Permanent Total Disability S$150,000 (Adult below 70 years) Trip Cancellation S$5,000 Baggage Loss/Damage S$3,000 For personal baggage and personal effects Limit S$500 per article, pair or set of items and S$1,000 for one unit laptop computer Emergency Medical Evacuation & Repatriation S$1,000,000 |

Overseas Medical S$200,000 Personal Accident & Death S$200,000 (21 years to 70 years) Trip Cancellation S$7,500 Baggage Loss/Damage S$3,000 Emergency Medical/Evacuation/Repatriation Unlimited |

Overseas Medical Expenses S$250,000 Accidental Death S$50,000 Trip Cancellation/Postponement S$5,000 Baggage Loss/Damage S$1,500 Emergency Medical Evacuation S$1,000,000 |

|

Promotions |

With COVID-19 Coverage. Receive your policy documents immediately. 26 April - 28 April 2024 Single Trip Plan

|

COVID-19 is not included (optional/ add on) 23 April 2024 - 28 April 2024 Single Trip Plan

|

With COVID-19 Coverage. 1 April - 30 April 2024 Single Trip/ Annual Plan

|

Related Story: The Best Travel Insurance in Singapore For COVID-19 Coverage

Securing Tomorrow with Confidence

Insurance gives you the wings you need to live your life confidently as it covers many aspects — health, finances, personal accidents, critical illnesses, and even ensuring your family is secure when you are no longer around.

As your income bracket grows, ensure that you scale your insurance coverage to stay protected—and if need be, assess your coverage from time to time.

Enquire more and contact us today!

Want to know more about AMTD PolicyPal Group insurance plans?

Cannot find what you are looking for? Please reach out to us at Contact AMTD PolicyPal

Read More

Best Home Insurance in Singapore 2023

Travel Essentials Checklist For Your Family Vacation

Best Personal Accident Insurance in Singapore 2023

Protected up to specified limits by SDIC. This content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on our Site constitutes a solicitation, recommendation or endorsement by AMTD PolicyPal Group in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction. You may wish to seek advice from a qualified adviser before buying the product.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Under AMTD Digital, AMTD PolicyPal Group consists of PolicyPal Pte. Ltd., Baoxianbaobao Pte. Ltd., PolicyPal Tech Pte. Ltd., and ValueChampion.