The Central Provident Fund (CPF) is at the heart of the financial landscape in Singapore, offering a solid framework for healthcare, housing, and retirement. While CPF is a reliable safety net, you can also use insurance policies to complement it and enhance your financial coverage.

This article will demonstrate how CPF and insurance can be used jointly to create a robust financial safety net. By understanding the nuances of each, you can make informed decisions to fortify your financial well-being for a better tomorrow.

Related Story: A Guide to Understanding the CPF

An overview of health insurance

Health insurance is as important as securing a sturdy roof over your head. Just like a roof shields you from unforeseen weather, health insurance safeguards you from unexpected events like accidents or illnesses.

When it comes to health insurance, it’s vital to obtain the right amount of health insurance coverage. With a solid health insurance foundation in place, you are better positioned to weather health-related challenges that come your way.

Types of health insurance in Singapore

The table below summarises the health insurances available and how they benefit you.

|

Health Insurance Type |

Purpose |

|

Medical Insurance |

Helps in managing expensive medical costs |

|

Life Insurance |

Provides financial compensation if you are unable to work and it affects your income |

|

Critical Illness Insurance |

Softens the financial strain if you are diagnosed with a critical illness, e.g. cancer or heart attacks |

|

Personal Accident Insurance |

Provides a lump-sum payout if injured or disabled due to an accident |

|

Disability Insurance |

Protects your income if you’re disabled |

Source: CPF Board

How to pair medical insurance with your CPF coverage

Every Singaporean benefits from basic medical insurance via MediShield Life. This crucial component gives you lifelong coverage irrespective of your age or medical condition and also helps alleviate the costs of medical bills.

You can elevate the value of your health insurance coverage by supplementing it with an Integrated Shield Plan (IP) and its respective riders.

Why you should complement your CPF coverage with Integrated Shield Plans (IP)

MediShield Life provides payouts based on B2/C-type wards in public hospitals, covering part of your medical expenses. Opting for an A/B1-type ward or a private hospital will result in MediShield Life covering a smaller bill portion. Also, while there is no lifetime claim limit, MediShield Life has an annual claim cap of S$150,000.

An IP from a private insurer provides additional coverage, including non-subsidised treatment in public hospitals and coverage for treatments in private hospitals. This factor makes IPs the preferred choice for individuals seeking better hospital care while seeking medical treatment.

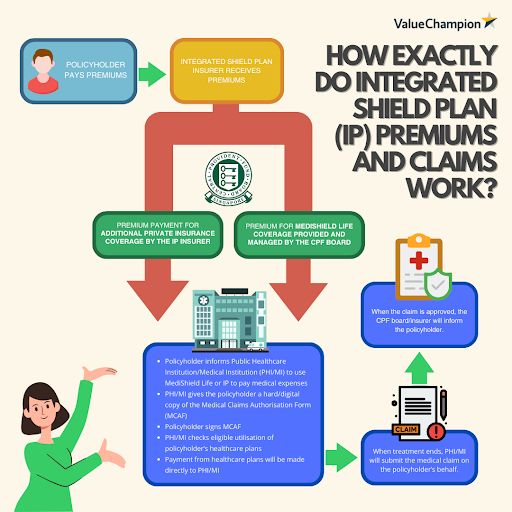

When it comes to payments for your IP, your IP insurer serves as your sole point of contact, acting on behalf of the CPF Board to handle premium collection and claims disbursement for the MediShield Life component of your IP.

Related Story: How To Get the Most Out of Your Integrated Shield Plan

Life insurance in Singapore

Life insurance provides a financial safety net for dependents in the event the policyholder passes on. It offers a lump-sum payout, the death benefit, to beneficiaries designated by the policyholder.

Here in Singapore, life insurance consists of two categories: term life insurance and whole life insurance.

Term life insurance

Term life insurance provides you and your family a lump-sum payout in the event of disability, terminal illness, critical illness (optional), or death, with coverage up to a specified age, such as 75 years of age.

Whole life insurance

In case of a disability, terminal illness, critical illness, or death (based on your chosen life insurance plan), your whole life insurance gives a lump-sum payout, followed by potential cash returns throughout your entire life.

How to use life insurance to complement your CPF coverage

There are three ways you can enhance your CPF coverage, including using life insurance. The three options are via your CPF account itself or CPF Life, the Dependants’ Protection Scheme, and CareShield Life or CareShield Life supplements.

CPF Account / CPF Life

When a Singaporean citizen passes on, the beneficiaries listed under the CPF account will receive his or her CPF or CPF Life premium balance. The CPF Life premium balance is the total sum of the CPF Life premium paid to date minus the payouts received (if any) and any remaining CPF savings.

Depending on the sum accumulated, it might support your dependants for a shorter period of time than you expect. In order to cover financial gaps, it would be ideal to support your CPF Life coverage with a life insurance plan.

There are two CPF plans that can enhance your life insurance coverage: the Dependants’ Protection Scheme (DPS) and CareShield Life supplements.

Dependants’ Protection Scheme (DPS)

The Dependants’ Protection Scheme (DPS) functions as a term-life insurance, offering financial support to insured members and their families in the event of untimely death, terminal illness, or total permanent disability. This coverage is applicable up to the age of 65.

For members aged up to 60 years, the maximum sum assured is $70,000. As for those between 60 and 65 years, DPS provides coverage up to a maximum sum assured of $55,000.

You will receive automatic DPS coverage once you make your initial CPF working contribution, provided you are a Singapore Citizen (SC) or Permanent Resident (PR) aged between 21 and 65. However, If you’re between age 16 and 65 years and have not been automatically covered by DPS, you can apply to join DPS with Great Eastern Life directly.

Great Eastern Life is the exclusive administrator of DPS*.

Careshield Life/ CareShield Life supplements

The government offers CareShield Life, a long-term insurance scheme that extends coverage for basic financial support. Coverage under CareShield Life includes severe disability (especially during old age) and if the insured party requires personal or medical care (or both) for a longer term. This insurance scheme is automatic for individuals born in 1980 or after but optional for those born in 1979 or earlier.

If you’re covered under CareShield Life and ElderShield, exploring Supplements from private insurers is a smart move. These can bring extra perks like larger payouts or coverage for less severe disabilities.

There’s no cap on the number of supplement policies you can have. Plus, you can use MediSave to cover the premiums, with a yearly limit of S$600 per insured person (by calendar year).

Keep in mind that these Supplements come in various types, with premiums varying based on the benefits they provide. It’s all about finding the right fit for your needs.

The three providers of CareShield Life/ElderShield Supplements are Great Eastern Life, Income, and Singlife.

The primary uses of life insurance

In the four segments below, you’ll find the top uses for life insurance coverage.

Income replacement

Life insurance helps replace the lost income of the policyholder, ensuring that their dependents can maintain their standard of living.

Debt repayment

One can use life insurance to settle outstanding debts, such as mortgages, loans, or other financial obligations, preventing the burden from falling on surviving family members.

Education funding

Life insurance proceeds can be used for funding a child’s education, ensuring that educational goals are secure.

Estate planning

Life insurance can facilitate the smooth transfer of assets and wealth to beneficiaries, mitigating potential financial complexities.

Related Story: Best Term Life Insurance in Singapore 2024

You can significantly enhance your overall financial protection by strategically integrating your medical and life insurance policies with your CPF coverage. Select and optimise insurance plans to suit your needs and your dependents to ensure comprehensive coverage.

This proactive approach not only safeguards your financial well-being but also provides you with peace of mind, allowing you to navigate life’s uncertainties with greater confidence.

Remember to review and adjust your insurance portfolio regularly. This helps to align your insurance portfolio with changing life circumstances to ensure that your coverage remains relevant and tailored to your evolving needs.

*correct at the time of publishing

Enquire more and contact us today!

Want to know more about AMTD PolicyPal Group insurance plans?

Cannot find what you are looking for? Please reach out to us at Contact AMTD PolicyPal

Read More

Welcome to Adulthood: Insurance Edition

How to Retire Comfortably in Singapore

How to Determine The Insurance Coverage and Policies You Need

What You Need to Know About An Investment-Linked Insurance Policy (ILP)

Disclaimer: This content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on our Site constitutes a solicitation, recommendation or endorsement by AMTD PolicyPal Group in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Under AMTD Digital, AMTD PolicyPal Group is a leading Singapore-based FinTech company. AMTD PolicyPal Group consists of: PolicyPal Pte. Ltd., Baoxianbaobao Pte. Ltd., PolicyPal Tech Pte. Ltd., and ValueChampion