Learn how to attain financial prudence while maintaining comprehensive insurance coverage. Maximise the benefits of your insurance plans with these valuable tips.

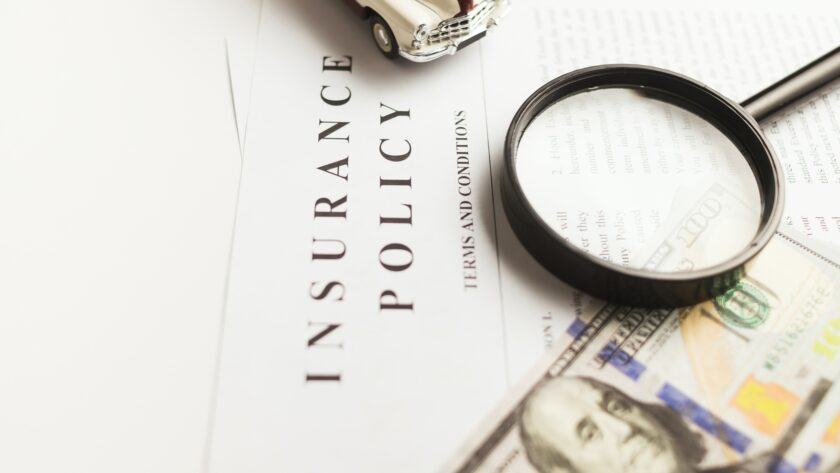

Insurance plays a pivotal role in our financial lives, offering protection and peace of mind in times of need. However, for many individuals and families, insurance premiums can be a significant expense. The good news is that you can be financially frugal without compromising on coverage.

This article explores practical strategies to help you maximise the value of your insurance policies in Singapore.

1. Do a health check on your current insurance coverage

The first step to take towards maximising the value of your insurance involves conducting a self-audit on your current insurance plans. The table below illustrates the angles you need to consider as you conduct your personal insurance audit.

|

Insurance Assessment Angle |

What You Need To Do & Know |

|

Understand your financial health |

Conduct a comprehensive self-assessment of your current financial and life circumstances Evaluate your income, assets, debts, and financial goals. |

|

Life stage analysis |

Discover specific insurance needs you may have based on your current life stage Analyse your stage in life:

Each stage brings unique insurance requirements |

|

Health insurance |

While MediShield Life offers basic health insurance coverage to Singapore Citizens and Permanent Residents, you can consider enhancing your coverage through a MediSave-approved private Integrated Shield Plan (IP). These plans provide Singaporeans with coverage against costly medical bills should the unexpected happen. You should first review your current health status:

MediShield Life is a basic health insurance plan that covers B2/C bills. Administered by the Central Provident Fund (CPF) Board, which helps to pay for large hospital bills and selected costly outpatient treatments, such as dialysis and chemotherapy for cancer. It is structured so that patients pay less MediSave/cash for large hospital bills. Integrated Shield plans provide additional coverage beyond MediShield Life with higher annual policy limits. It also provides a higher coverage of stay in Private Hospitals, and Class A/B1 wards in Public hospitals, depending on the type of coverage you select. |

|

Car insurance (Optional) |

For car owners, car insurance is subject to a yearly renewal. Before an auto-renewal of your car insurance coverage with your existing insurer happens, consider:

|

|

Home insurance |

As a homeowner, you can purchase home insurance to protect your home from fire, water leaks, damages caused by natural disasters, theft, and more. Look at the protection for your home based on these coverage angles:

Some insurers offer one or more of these coverages as a bundle, while with others, you could opt for additional coverage e.g. home contents insurance coverage. Pick what suits you (and your budget) best to get the best value out of your home insurance. |

|

Life insurance |

While this may be an optional insurance plan, it is a worthwhile insurance to consider, especially if you want to ensure that you and your dependants are not affected financially while you recover from critical illnesses. Life insurance also covers Death/Terminal Illness and Total and Permanent Disability. |

|

Long-term care insurance coverage |

ElderShield/CareShield Life is a basic long-term care insurance scheme targeting severe disability, especially during old age. ElderShield policyholders are covered under one of two basic ElderShield plans:

This insurance plan comes in handy as it offers lifetime coverage and monthly cash payouts (for up to 5 or 6 years, depending on the plan). This can give you the flexibility to decide on your desired care arrangements, i.e. home care or nursing home care. CareShield Life benefits are designed to provide you with lifetime protection and assurance for your basic long-term care needs, should you develop a severe disability. Singaporeans & PRs born in 1980 or later are automatically covered under CareShield Life from 1 October 2020, or when you turn 30, whichever is later. If you are born between 1970 and 1979, insured under ElderShield 400, and have not developed severe disability, you have been automatically enrolled into CareShield Life from 1 December 2021. No action is required if you wish to join CareShield Life. If you are not automatically enrolled and wish to join CareShield Life, you may access the Application to join CareShield Life e-Service with your Singpass. Monthly Payouts start at S$600/month in 2020 and increase over time. Your monthly payouts will increase annually until age 67 or when a successful claim is made, whichever is earlier. Once a successful new claim is made, your monthly payout amount will remain fixed for the duration of your severe disability. From 2020 to 2025, payouts will increase by 2% per year. Thereafter, payout increases and corresponding premium adjustments will be recommended by an independent CareShield Life Council. |

Once you have assessed your insurance needs based on your current life stage and circumstances, break down and finalise the coverage you have or may require. The most considered types include additional healthcare insurance coverage, home insurance, and life insurance.

2. Go insurance comparison shopping

One of the basic principles of getting the best value out of your money is shopping smartly. It may not pay to stick with the same insurer for home and car insurance, for example. You may be missing out on better deals, and all you need to do is either apply a promo code or use a comparison tool.

Want to know more about insurance plans?

Why maintaining a good credit score helps you save money

While there is no full disclosure to the public on how insurance companies determine your premium sum, insurance companies are known to utilise insurance history and credit report scores to develop an insurance risk score.

Individuals with low credit scores could be penalised with higher insurance premiums, while those with lower scores benefit through a smaller car insurance premium sum.

Related Story: Is It Time To Invest in Bonds for Passive Income Again?

3. Consider your coverage limits

Ensure that you are covered sufficiently from every angle you need. Seek professional advice from a financial advisor or insurance expert if necessary. They can provide you with the tailored guidance you seek, helping you make informed decisions.

Proactively review and realign your insurance coverage

Life is a constant cycle, and your insurance coverage should adapt to suit your needs as they change, too. Marriage, parenthood, home purchases, and other life events are significant milestones that call for insurance coverage adjustments.

Review your policies periodically to ensure that your insurance coverage matches your needs, always.

4. Safety and risk management

Insurance serves as a shield against the unpredictability of life. At its core, it’s all about effectively managing risks. To get the most out of your insurance, it’s imperative to take proactive steps to mitigate potential risks, too.

Examples of steps you can take include maintaining a clean driving record slate, preserving your No Claim Discount for a lower insurance premium rate when you’re up for a car insurance renewal.

Related Story: How Much Insurance Coverage Do You Really Need And What Policies Should You Get?

5. Be aware of policy exclusions and inclusions

The fine print of your insurance policy is a crucial aspect of responsible financial planning. In order to avoid pitfalls while also ensuring you get the maximum value out of an insurance plan, you will need to delve into the nitty-gritty details.

Understand what’s included in your insurance coverage

Policies come with a host of benefits that cover a specific type of risk. Gain a better understanding of these benefits to help you leverage them when the need arises and make informed decisions about your coverage.

Identify and understand exclusion clauses

Paying closer attention to a policy’s wording (most often found on the insurer’s website page) will help you know scenarios, situations, or events that an insurance policy does not cover. This could range from pre-existing health conditions in health insurance to specific natural disasters in home insurance or risky behaviours or jobs in life insurance.

By taking the time to understand the exclusions, you’re better prepared for reality if it should happen. You can also take steps to mitigate risks that aren’t covered by your policy by exploring additional insurance coverage as well as add-ons or riders to fill the gaps.

6. Consider self-insurance and emergency funds

While insurance helps with the bigger coverages you need, what about the smaller risks?

If there are small, manageable risks, you could set up an emergency fund to cover the unexpected expense. This would help you save costs versus paying premiums for every possible scenario.

In conclusion, getting the best value out of your insurance involves making smart choices without having to break your bank account. By assessing your financial needs, shopping wisely, and optimising your insurance policy choices, you can strike a balance between protection and affordability.

Take action today and review your insurance policies today. Your future self will thank you for it.

Enquire More and Contact Us Today!

Want to know more about AMTD PolicyPal Group insurance plans?

Can’t find what you are looking for? Please reach out to us at Contact AMTD PolicyPal

Read More:

Welcome to Adulthood: Insurance Edition

The Best Travel Insurance in Singapore For COVID-19 Coverage

The Best Travel Insurance in Singapore for Families

Protected up to specified limits by SDIC. This content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on our Site constitutes a solicitation, recommendation or endorsement by AMTD PolicyPal Group in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction. You may wish to seek advice from a qualified adviser before buying the product.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Under AMTD Digital, AMTD PolicyPal Group consists of PolicyPal Pte. Ltd., Baoxianbaobao Pte. Ltd., PolicyPal Tech Pte. Ltd., and ValueChampion.