If the statistics are anything to go by, 2024 is probably the year where travel mania is going into full swing, with the restrictions truly behind us. In the last quarter of 2023, Changi Airport saw 16.1 million passenger movements, which was above 90% of pre-pandemic levels.

Yet, the costs of travel surely did not stay the same as before the pandemic. In fact, almost everything from flights to hotels and attractions have become costlier. That has not deterred travel spending — in November 2023, Visa revealed in its Global Travel Intentions (GTI) survey that a 40% year-on-year increase in travel spending has pushed recovery to pre-pandemic levels.

For savvy travellers, spending mindfully is not just about sticking to a budget but how to enhance the quality of travel experiences within reasonable means. Seeing the world may come with a price tag but that doesn’t mean you need to only eat bread and drink water for the rest of the time. Here’s a quick look at how to get the most out of your time and travel dollars.

Related: The Best Travel Insurance in Singapore for Families

Pre-Trip

1. Travel During Off Season

Unless you’re travelling with school going children, the June–August period and the month of December are two periods where prices will spike in many destinations. If you intend to explore a place sans crowds, try to go during off seasons.

For instance, if you’re planning to visit Paris, which saw over 36.9 million million tourists in 2023, you may wish to consider travelling in the lull period after New Year. Not only is the wintry weather a cool respite from Singapore’s year-round humidity, the rainfall tapers off significantly in March, which means more pleasant sightseeing. While there are less festivities as compared to the summer months, the tendency of being pickpocketed is also lower too. The prices of accommodation may be significantly cheaper too.

Similarly, in Japan, Korea and Taiwan, March and April are good periods to consider travelling as the seasons change and crowds have yet to set in.

Related: Travel Diaries: 5 Safest Travel Destinations in the World

2. Considerations for travelling solo vs with friends or family

Source: Unsplash

Do you travel to get away from it all (including your family and friends), or do you see travelling as a meaningful way to bond with your loved ones?

Being mindful of your travel preferences enables you to make the most out of your travel plans. If you’re the planner for your family trips, understanding your travel companions is key to having a satisfying vacation.

For instance, Japan is a hotspot for many Singaporeans with its myriad landscapes and local delicacies. If you’re an outdoors lover, the outskirts will provide an unforgettable journey with the breathtaking nature views.

But if you’re travelling with a shopping fan, it would be thoughtful to allocate a portion of “free-and-easy” time to explore the city areas. If you’re travelling with elderly parents, would they prefer a hiking activity or a leisurely train trip that lets them rest and relax?

If you usually travel by yourself, the options are more flexible as you basically just need to think of what you want to do. Should you rent a camper van and save on staying in a hotel in a touristy area? Should you get the cheapest flight or top up a little for the best timing to maximise your trip? It’s all up to you.

Related: How To Survive and Thrive as a Solo Traveller

3. Hotel loyalty programmes to sign up for

Source: Pexels

Even if you’re not a frequent traveller, you would likely have heard of the Big 4 hotel loyalty programmes — Marriott Bonvoy, Hilton Honors, IHG One Rewards, and World of Hyatt, which collaborated with the Small Luxury Hotels of the World, a collection of over 500 hotels in 80 countries where you’ll find unique gems to stay at your destination.

Apart from member rates and earning points, hotel loyalty programmes are great for bonuses such as free upgrades and privileges such as using points to redeem access to exclusive event bundles. For instance, the sold out Taylor Swift The Eras Tour Concert with VIP Access to Hilton Honors Suite was redeemable for 100,000 points.

Leverage travel rewards and loyalty programs offered by airlines, hotels, and credit card companies. For instance Accumulate points through your regular expenses and redeem them for discounted or even free travel.

Many loyalty programs offer perks like free checked bags and room upgrades. Some hotel chains offer complimentary cocktails and canapés at the hotel lounge for certain room types so make sure you check before you book.

Related: Best Hotel Booking Sites 2024

Related: Best Travel Deals in Singapore

4. Getting the cards you need

With the wide range of travel credit cards available, picking just one can be tough.

If you’re planning to chalk up frequent flyer points over the year, it’s relatively easy to get an annual fee waiver by spending strategically. You can either book your flights with the same carrier, or check out flights on partner airlines within the same network. For instance, Star Alliance’s global network of 26 airlines includes Air New Zealand, Air Nippon Airways, Eva Air and Singapore Airlines. This lets frequent fliers earn, combine and redeem miles on partner airlines.

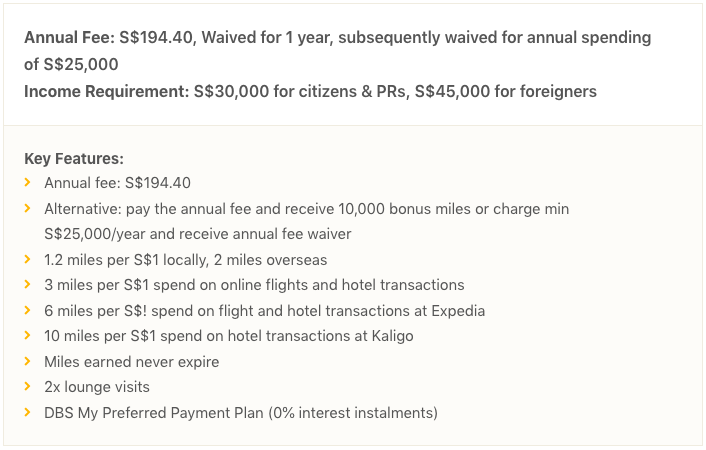

A good bet would be the DBS Altitude Visa Credit Card, which lets you accumulate points for miles redemption through online spending including flights and hotels booking. The best part? Miles earned never expire so you won’t have to constantly keep track of your miles. Here’s a quick look at the card features:

If you’re planning around 1–2 trips a year, getting a rewards card that lets you earn points without flying can accelerate your miles accumulation. Citi Rewards Credit Card is the card for you if you spend regularly on e-commerce, ride hailing, and food delivery services.

- 4 miles (10X Rewards) per S$1 on shopping purchases

- 4 miles (10X Rewards) per S$1 on online shopping (inc. food delivery, online grocery & ride-hailing services)

- 4 miles (10X Rewards) per S$1 on online shopping (inc. food delivery, online grocery & ride-hailing services)

- 1X reward point for every S$1 on all other spending

- No minimum spend required

- Rewards points conversion rates: 4,400 points = S$10 cash rebate, 25,000 points = 10,000 miles

- 10X rewards are capped at 10,000 pts per month

- 10X rewards excludes travel purchases online and non-fashion purchases offline

Whether you’re earning points for miles redemption or getting a multi-currency card/e-wallet, having a combination usually helps to bring some convenience and save some money. For instance, Revolut and YouTrip let users hold up to 33 and 10 currencies respectively, with a wallet limit of S$20,000. Users can also withdraw money at overseas ATMs for free for a number of times before a fee is charged. Some apps also charge a fee for currency conversion.

Related: YouTrip vs. Revolut Standard Digital Wallet Comparison

Related: Currency Crunch — How to Make Use of Weakening Currencies to Further Your Travel Plans

5. Purchase travel insurance

After you’ve booked your flights and confirmed your hotel reservations, it’s time to plot your itinerary right? Before you get knee deep into that fun stuff, be sure to get travel insurance in your pocket.

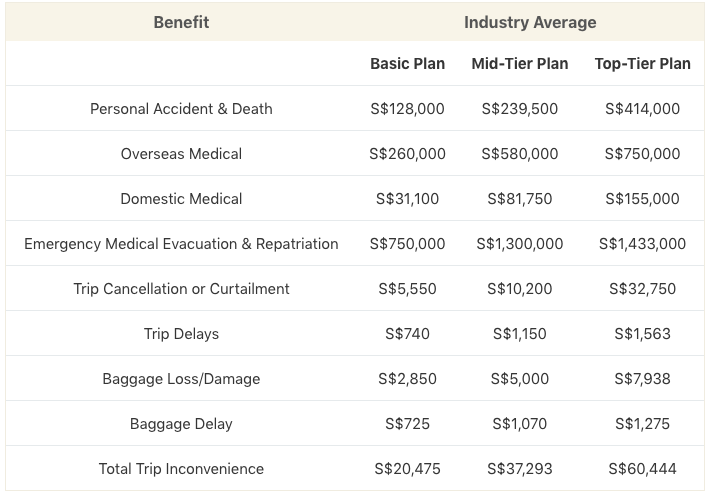

There is no price for peace of mind whether you’re travelling alone or with a group. Travel insurance is your best friend when there is a medical emergency, or when a flight delay happens. For most things that you can’t predict will happen on a trip, travel insurance is there for you for a small fee provided you have gotten the coverage before your trip.

Travelling may have resumed its wheels for the most part, but for some destinations where tourism is just starting to pick up, multiple flight delays are common. That’s when having the protection in place will help to ease some of the discomfort you may encounter on the road.

Source: Value Champion

Related: Average Costs and Benefits of Travel Insurance 2024

During The Trip:

1. Visit local grocery and food shops

Apart from avoiding tourist traps, you can shop at local grocery shops for cheap and convenient food. One of the highlights of travel is indulging in local cuisine, and if you see a long line that’s your hint. Opt for street food and local markets to savour authentic flavours without breaking the bank. Eating where the locals eat not only saves money but also provides a more immersive cultural experience.

Another thing about visiting mom and pop stores is they tend to stock up on products which the locals will buy, which means they are likely to be reasonably priced.

Related: Do You Know Whether Your Travel Insurance Covers Popular and Extreme Sports?

2. Take advantage of credit card perks

Source: Unsplash

From free airport lounge access to limo transfers and travel insurance, credit card perks do add a little more magic to travelling. Not to mention the allure of flying for free and getting hotel room upgrades.

Take your cue from YouTubers Kara and Nate, who shared the art of earning frequent flyer points through their video “How to Travel Anywhere in the World for Less Than $100”.

Having a separate card for travel expenses helps to streamline your finances, so it’s easier to track and spot any discrepancies.

If you’re looking for a welcome boost for your miles accumulation, American Express Platinum Card is offering new members a welcome offer of up to 135,000 Membership Rewards points with annual fee payment and a minimum spend of S$6,000 within two months of card approval.

For those looking to earn miles through everyday spending, UOB Preferred Platinum Card is your shopping buddy. With an impressive earn rate of 4 miles (2 UNI$) per S$1 spent on online shopping, entertainment and mobile contactless transactions, you can also earn instant cash back all year round for every transaction at participating merchants.

Long regarded as a favourite among online shoppers (and who isn’t one these days?), HSBC Revolution earns you 10X Reward points (or the equivalent of 4 mpd) for online and contactless spending. No annual fee is charged and you’ll also earn additional 1% cashback on transactions charged to the HSBC EGA account.

Related: Which Travel Credit Card Gives You the Most Travel Perks?

3. Don’t get too hungry

It sounds like common sense but when you’re inundated by fresh sights and sounds when you’re abroad, time just seems to fly. Before you know it, your last meal was six hours ago and you’re freezing somewhere where the sun doesn’t stay up for very long.

As the hunger pangs set in and start to get more persistent, you find yourself walking towards the nearest available food source, which turns out to be fairly lacklustre and overpriced. While it’s acceptable to expect to pay slightly more for meals on holiday, one way to avoid that scenario while buying some time for a quick spot of research is to prepare some snacks on the go.

For locations where you don’t necessarily want to spend on food, you can pack some granola bars or wheat crackers and water. Some people find nuts, dates, and raisins a good energy source to power through long days. Whichever choice you made, just make sure it’s sufficient to tide you through your itinerary.

Related: Travel Essentials Checklist For Your Family Vacation

Conclusion

To be sure, travelling is an escape for most of us and there are plenty of resources to tap on, whether you’re researching itineraries or ways to do budget travel.

Embarking on a budget-friendly adventure doesn’t mean sacrificing the essence of travel. In fact, using some of these budget travel tips can help you create unforgettable memories without straining your finances. Ultimately, it’s creating beautiful memories that will stay with you, rather than simply striking off a Michelin restaurant on your list.

So, pack your bags, embrace the thrill of the unknown, and let your budget-friendly journey unfold. Happy travels!

Related: Effective Travel Hacks To Maximise Savings When Travelling & Shopping Overseas

Ready to set off? Be sure that you have sufficient insurance coverage for yourself and your travel companions. Explore and compare the best travel insurance plans here!

Read more:

- How To Maximise Credit Card Rewards And Beat Inflation

- Travel Essentials for Every Trip – From the Best Travel Insurance to Miles Credit Card

- 3 Best Credit Cards For Women In Singapore

- Cash Or Credit Cards: Which Is Better To Use When Travelling?

- A Basic Guide to Supplementary Credit Cards

This article first appeared on ValueChampion (part of AMTD PolicyPal).

Disclaimer: This content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on our Site constitutes a solicitation, recommendation or endorsement by AMTD PolicyPal Group in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Under AMTD Digital, AMTD PolicyPal Group is a leading Singapore-based FinTech company. AMTD PolicyPal Group consists of: PolicyPal Pte. Ltd., Baoxianbaobao Pte. Ltd., PolicyPal Tech Pte. Ltd., and ValueChampion