For most Singaporeans, the concept of financial freedom comes tied closely with the sentiment of striking Toto/4D. Indeed, if you’re not one of the four lucky winners of the recent S$12 million Hongbao Draw, the idea of being financially free can seem as distant as the moon. With the rising costs of living and incurring debt from housing loans to car loans, it is little wonder most regard winning the lottery as the golden ticket to a worry-free future.

Can a million-dollar windfall truly change your life? Not if you don’t know what to do with it other than think of all the ways you could spend the money! If you’re ready to clean up your finances, here are some common budgeting mistakes and tips to rectify them.

Budgeting Mistake #1 – Not Saving Early

If you need to hear it from a wise person, Einstein did mention, “Compound interest is the eighth wonder of the world.”

Needless to say, you won’t regret making saving and investing a priority in your financial plan. Some may say having sufficient earning power is more important than saving early. In a climate where the cost of living has risen significantly in a short span of time, this can make it difficult to cover basic expenses and save for the future.

With stagnant wages not keeping pace with the rate of inflation, increasing one’s earning power does play a part. What’s also important is inculcating the habit of saving small from the first pay cheque to leverage on the power of compounding.

For instance, a friend decided to deposit S$20 (the minimum sum required) every month into a low-risk money market fund with 8% return, and after six years received a S$1,500 cheque out of the blue.

In order to save more, the easiest way is to spend less. Instead of scrimping every penny, think of it as making more mindful decisions about your spending. In a nutshell, think of “the latte effect”.

Related: A Basic Guide to Savings Accounts in Singapore

Budgeting Mistake #2 – Not Defining Your Financial Goals

Whether as a single or couple, one of the most crucial yet underrated things you can do for yourself and your partner is defining and prioritising your financial goals. And that can only come with the awareness of being financially educated.

With the major life transitions that one may go through, such as buying a house, getting married, or having children, having a reactive approach towards financial planning can feel like you’re playing catchup with your cash flow all the time.

With the plethora of resources, from online platforms to free webinars, it is really in your hands to stay informed and make the best decisions for you. Just because your cousin got a promotion and decided to upgrade to a condo doesn’t mean you should also start looking at property listings and mortgage loans. These decisions come with a hefty price tag and long-term commitment, which definitely deserve a lot more consideration other than FOMO.

Similarly, if you’re in a shared household with your partner, make it a point to stay on top of the finances even if one partner is in charge of the overall management. This ensures accountability for making any money decision that can potentially impact the family.

Related: How to Plan Your Finances for Short, Medium and Long Term Goals

Budgeting Mistake #3 – Not Prioritising Financial Goals

Balancing short-term goals (such as paying off debt) with long-term goals (such as saving for retirement) can be challenging for anyone. More so for those who are trying to navigate different financial priorities such as raising children.

For some, one of these short term goals may be to travel more. With revenge travel taking momentum among wanderlusters, it’s easy to get swept up in the buzz and overlook higher travel costs in the name of striking off your bucket list items. The pain only sinks in when it’s time to head back to reality, where a rather anaemic bank account balance (and somewhat shocking credit card bill) awaits.

Resist the urge to impulse purchase when “cheap” flight and hotel deals arrive in your inbox. Instead, plan ahead for your trip and set up a separate savings pot for your discretionary spending (such as travelling) and only buy when you have the money.

Making informed decisions about budgeting, investing, and managing debt are life skills that were unfortunately not mandatory subjects in school. Take heart that it’s never really too late to learn and improve your personal finance knowledge and quality of life in the process.

Related: How To Set Financial Goals As A Couple

Budgeting Mistake #4 – Not Investing In Yourself

When it comes to upgrading your skills, too often we hear (and make) the excuse, “I don’t have enough time for sleep, much less go for courses!”

Instead, to compensate ourselves for pulling yet another all nighter, we indulge in a Netflix marathon weekend or play games. Then come Monday, it’s back to the dreaded commute to office and the daily grind. And you wonder why people keep complaining they don’t have time and are tired…

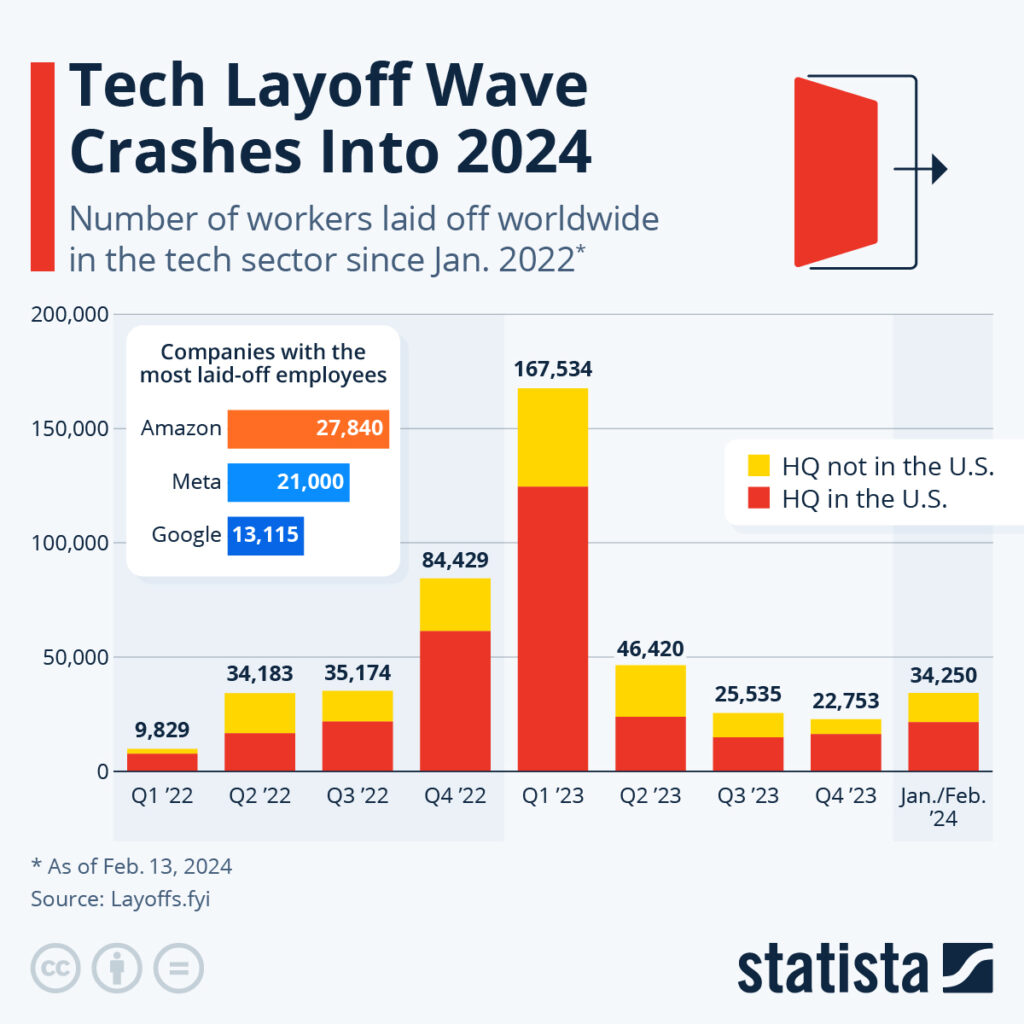

Truthfully, when things are going well at work, there seems little incentive to upskill. After all, you are entrusted with the big projects, have a reliable team to run the show, and are basically well regarded by your company. That was likely what many of the folks in the tech sector felt about their jobs.

While up-skilling and staying up to date on skills doesn’t equate job security, it does mean another potential avenue for earning should the worst case scenario happen.

In the event of retrenchment, some of us may participate in the gig economy or apply for part-time or contract roles. This can mean income instability and the lack of employee benefits such as health insurance.

To mitigate these uncertainties, start pooling an emergency fund of 6-12 months’ worth of living expenses. Ensure you’re adequately protected with health insurance coverage to avoid financial setbacks should a health crisis occur.

Related: Making a Career Switch? These Are the Most Lucrative Industries to Be In 2024 and Beyond

Budgeting Mistake #5 – Overspending And Not Managing Debt

On 27 November 2023, the Monetary Authority of Singapore released its annual financial stability review report and stated that household vulnerability to income and interest rate shocks had risen slightly “due to higher short-term debt like credit card spending”.

On a personal level, it’s relatively easy to overspend by rationalising certain big-ticket expenses such as planning for a wedding, renovation, or purchasing a new home.

Housing costs, including rent and home prices, can be prohibitively high especially in popular areas. This makes it challenging for younger Singaporeans to save for a down payment or afford monthly mortgage payments.

Accumulating credit card debt is common and can lead to potential long-term financial consequences if not managed carefully.

Don’t let debt become a significant obstacle on your path to financial freedom. Take control by creating a strategy to pay off high-interest debt systematically, starting with credit cards and loans carrying the highest interest rates.

Consider refinancing options to lower interest payments and accelerate debt repayment. Avoid accumulating additional debt, and focus on living within your means.

Related: Best Savings Accounts in Singapore 2024

Budgeting Mistake #6 – Not Understanding The Difference Between Investing and Gambling

If you’ve ever made a loss by investing in something based on someone’s recommendation, congratulations.

You have learnt a valuable lesson that investment comes with risk and hopefully also realised the cost of making investment decisions based on hearsay and not research.

Unlike the lottery, where you can purchase the “hope” of becoming a millionaire for as little as S$1, investing requires patience and discipline to research the companies you are keen to invest in, and sticking to your investment thesis.

After setting aside your emergency funds, you may consider exploring investment options. Make an effort to understand the fundamental differences between the various instruments such as stocks, bonds, mutual funds, or real estate investment trusts.

At the same time, keep in mind your risk tolerance and investment objectives in order to stay the course. Unless you’re a professional investor, most people will not be able to benefit from stock picking like billionaire Warren Buffett. A more realistic approach would be to open an online brokerage account and build an investment portfolio that you can easily manage.

For long-term planning, apart from contributing to your CPF retirement sum, investing in T-bills and Singapore Savings Bonds may help to further secure your financial future.

Related: Effective Techniques To Make Value Investing Work For You

Budgeting Mistake #7 – Choosing to Invest or Pay Off Debt

Circling back to the million-dollar question — what should you do when you have an unexpected large sum of money?

Whether you should pay off your debt or make an investment depends on the size of your debt. If it is a high-interest debt, paying it off is likely to benefit you more than any investment.

Why experts may recommend investing and paying off debt at the same time is when your investments have a higher rate of return than the interest on your debt. For instance, if you have sufficient money for an investment that can yield a 9% return on your investment vs paying off a loan with a 3% interest, it could make sense to do both.

Conclusion — When does one become financially free?

As with any big goals, achieving financial independence or freedom requires discipline, patience, and strategic planning.

Having a goal and a plan to work towards them makes your efforts more focused. By setting clear goals, managing debt, investing in yourself, and embracing a prudent mindset, it is possible to overcome financial challenges and build a secure future.

Although the path to financial freedom may be challenging, reaping the rewards of financial independence makes it well worth the effort. Start your journey today and empower yourself to create the life you desire.

Read more:

5 Financial Mistakes That Single 30-Somethings Make

5 Fun Side Gigs to Supplement Your Day Job Income

5 Financial Lessons Regular Investors Can Learn From The Goldfinger

4 Interpersonal Skills You Must Develop If You Want a Promotion

Should You Consider Accepting a Job You’re Overqualified For?

Cover Image: Unsplash

Enquire more and contact us today!

Want to know more about AMTD PolicyPal Group insurance plans?

Cannot find what you are looking for? Please reach out to us at Contact AMTD PolicyPal

Disclaimer: This content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on our Site constitutes a solicitation, recommendation or endorsement by AMTD PolicyPal Group in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Under AMTD Digital, AMTD PolicyPal Group is a leading Singapore-based FinTech company. AMTD PolicyPal Group consists of: PolicyPal Pte. Ltd., Baoxianbaobao Pte. Ltd., PolicyPal Tech Pte. Ltd., and ValueChampion